China Edges Out Vietnam To Return As Top Exporter To U.S.

Vietnam’s ascent to the top of the list of countries shipping furniture to the U.S. market in 2020 was dramatic — displacing long-time No. 1 China — but also brief.

With 2021 numbers now in hand, Furniture Today’s research shows China has regained the top spot among the United States’ import leaders, sending $9.117 billion in furniture to the U.S. market, an increase of 24% over the previous year. Previous leader Vietnam wasn’t far behind, however, with exports for the United States reaching $9.1 billion, up 23% over 2020. The two countries are now even in terms of world market share at 31% apiece.

Despite China’s strong showing, it wasn’t able to match its 2019 mark of $9.713 billion in product imported into the U.S., although it did turn 2020’s negatives in its Top 5 categories, led by wood frame upholstered seats, into double-digit, positive gains across the board.

In fact, it was a good year in general for countries that supply the United States, with the world total eclipsing the $29 billion mark — a robust 28% rise from the previous year’s $22.7 billion — and with all Top 10 countries showing a gain, including nine of 10 seeing a double-digit increase. This is a major shift from 2020, when the world total fell by 1% during the onset of the pandemic and the uncertainty it fomented.

The ongoing pandemic may also be the catalyst that vaulted China back into its leadership position.

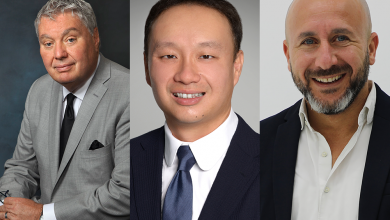

“I’m a bit surprised to see China regaining the top spot,” said Terry McNew, president and CEO, Klaussner Home Furnishings, “but I believe it has more to do with Vietnam shutting down in August and September of 2021 due to COVID than anything else.”

And with China now experiencing its own round of pandemic-related shutdowns, he said, “I wouldn’t be surprised to see Vietnam gain the No. 1 position in 2022.”

Mexico makes its move

In another significant repositioning, Mexico, which was No. 4 among U.S. source countries in 2020, jumped into the No. 3 slot by improving its total by 61% to reach $1.919 billion. It also picked up 2 percentage points in world market share, currently accounting for 7% overall.

Mexico improved exports to the U.S. across its leading segments, but especially in wood frame upholstered seats and chairs, up 86% and 81%, respectively, and with wood kitchen furniture, which rose by 124% to $203.5 million.

Meanwhile Malaysia, which still saw a modest 3% increase, dropped down a spot among the Top 10 after vaulting two positions just a year earlier. It also dropped a percentage point in global market share to 5%, tied with Canada. Malaysia was flat or down slightly in three of its leading categories: wood kitchen furniture, wood bedroom furniture and wood beds.

McNew pointed to the slowdown in globalization as a possible cause for Malaysia’s current stagnation as well as for Mexico’s rise among U.S. import sources.

“Due to a nearly two-year issue with Asian supply chains, the world will become more regionalized and this is giving Mexico renewed strength as many U.S.-based manufacturers are looking to Mexico for near-source opportunities,” he said.

For Kuka Home North America, the expansion of its manufacturing campuses in Mexico was expedited by “the political issues that brought the 25% tariff (on Chinese exports) and the struggles related to the COVID pandemic,” said President Matt Harrison, who also cited labor and supply chain issues as hurdles for manufacturing.

An available and eager workforce is a factor working in Mexico’s favor, according to Jim LaBarge, CEO at Marge Carson, which moved 100% of its production to Mexico in early 2021, although the company has been producing upholstery in Mexico for about 24 years and was well-established in the area.

“There is still a supply of Mexican workers who are interested in learning to cut, sew and upholster, which seems to be an issue in the U.S.,” he said.

LaBarge anticipates Mexico “will continue to grow market share of upholstery due to the variation of fabric applications, which creates longer lead times for delivery from Asia.”

Although his company has been producing in Mexico for 11 years, it was only recently, with the rise in container freight costs and the continued inconsistency of supply from Asia, that retailers have been motivated to look more seriously at Mexico as a supplier, said Jonathan Bass, CEO at Whom Home, a producer of fabrics, upholstered furniture, case goods and home accents.

While this has boosted Mexico’s 2021 numbers, Bass cautioned that the Mexican industry doesn’t operate under the same model as Vietnam or China.

There are fewer and smaller factories in Mexico, so the ability to scale can be challenging. Labor costs may be more favorable than in the United States, but they are still high. And depending on where factories are situated, there are in-country freight issues to overcome.

“The farther from the border, the more difficult the supply chain,” he said.

Mexico’s advantage, he said, is the ability to shorten lead times “and get the consumer what they want, when they want it.”

Pat Hayes, vice president of imports at Martin Furniture, which builds its office and entertainment furniture at its factory in Mexico while also importing a smaller percentage of goods from Indonesia and India, also sees Mexico gaining more market share in the years to come, along with some South American and Latin American countries.

“Ocean freight rates most likely will never go down to what they were pre-pandemic,” said Hayes, adding, “As the (Mexican) factories upgrade their machinery and are able to produce more sophisticated looks, they can definitely become a top contender with furniture production.”

A multi-country strategy, rather than relying on a single country to produce furniture, makes the most sense for Kuka Home during these unprecedented times.

“Kuka Home currently plans to make a specific mix of all product categories, including mattresses, out of Mexico,” explained Harrison. “However, each country — China, Vietnam and Mexico — all have different advantages that we intend to expand upon to service our customers. Time will tell how the market share for each country ends up. The pandemic and tariffs will continue to play a role in that mix,” he said.

Other countries make gains

While much of the emphasis has been on the changing fortunes of the three major suppliers to the United States, the remaining Top 10 countries held their positions and improved their numbers in 2021, with Italy and Indonesia having now joined last year’s Top 5 in the $1 billion-plus category.

Italy saw its biggest gain in wood frame upholstered seats (up 72%) and wood bedroom furniture (up 57%), while Indonesia’s strongest categories were teak chairs and wood dining tables.

Coming off 2020 when it experienced a 100% gain in exports to the U.S., Thailand continued to gain share with a 55% jump in business, registering triple-digit percentage increases in wood kitchen furniture (up 181%) and convertible seats (up 128%).