China Outlook Report

Part I. General Situation

The COVID-19 pandemic has been well controlled in China since last year, with only occasional affections in some regions, so there has been no second wave nationwide so far. However, it is worth noting that the latest spread, starting from the end of October, covers many a provinces and metropolises, causing over 100 newly reported cases within a day at the peak. As a result, related control policies are more constrictive than before. Thanks to strong government actions, this spread dies down quickly. It may end before 2022. As vaccination program proceeds quite successfully in China, the possibility of serious outbreak is lowered to a minimal extent. There have been 2.6 billion doses of vaccines used to protect people, and the number continues to go up at relatively fast speed.

Benefiting from the generally good situation, China’s economy is on a steady up trend. It has started recovery since 2020, and the GDP growth of the first half of 2021 is 12.7%. It is estimated that the economy will keep the bouncing trend. The year-round GDP growth rate is expected to be 8.5%.

From a midterm perspective, the 14th Five-Year Plan adopted this year by the country indicates China’s next development focuses. This Plan looks at “Long-Range Objectives Through the Year 2035”, which are proposed last year by CPC Central Committee, to formulate the development goals of the next five years. The goals cover six aspects — economic development, reform and opening up, societal civilization, ecosystem and environment, people’s welfare, and governance. The furniture industry also formulated its own 14th Five-Year Plan under the national framework. It will be focused on such issues of science and technology, product quality, innovation, green sustainability, standards and branding. Specifically, the development tasks are strengthening the basic abilities, improving industrial structure, supporting environment protection, bettering the standard system, building a good furniture exhibiting sector, encouraging cross-industry cooperation, producing more high-quality human resource, establishing a “dual circulation” development pattern1.

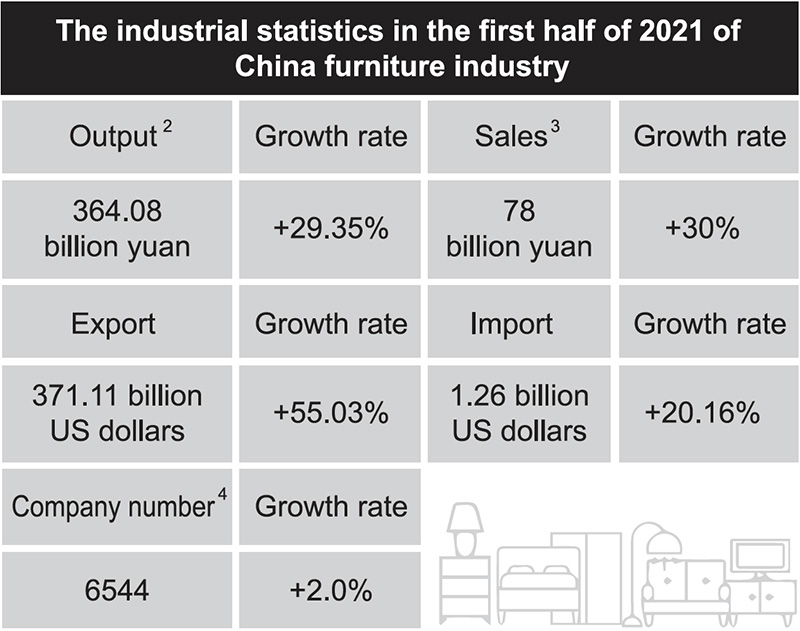

Part II. Recent Industrial Performance

Since the pandemic has been of limited scale, the furniture industry already assumed production from the early period of the last year. However, the international situation is not the same. Many countries have not recovered their logistics, so China’s furniture export faces challenges, though the overseas demand remains strong. Also China sources many kinds of materials from abroad, such as wood, metals, chemicals, etc. The suspension of production of these materials in other countries noticeably influences China’s furniture industry. The most obvious result is that the product price keeps going up.

After making adjustments to the challenges brought by the pandemic, China’s furniture industry has undergone several changes. First and foremost, digital technologies become widespread. From manufacturers to distributors, from relaters to exhibition organizers, such things as smart factory, e-commerce, online showroom, AI logistics and so on are adopted more than before. Second, the suppression of consumption at the start of pandemic and then the following purchasing boost make the industry go through apparent downs and ups. Some companies, especially small ones did not make it through the pandemic, so the market becomes more concentrated. Last but not the least, China is the largest exporter in the world. The pandemic constrains international trips, therefore leading China’s connection with other countries to inconvenience. Although the overseas orders keep coming home, part of the industrial potential is still limited.

Part III. Response & Forecast

Again as the COVID-19 pandemic in China moderates a lot, the furniture industry now mainly takes actions to live with it. Only at the early stage of the outbreak the industry needed to address it. To deal with the COVID-19 challenges, the furniture industry took its social responsibility and made contributions to the fight against the virus. China National Furniture Association (CNFA) together with local furniture associations urged all industry stakeholders to stand by each other and connected furniture companies to governments and aid agencies. By various kinds of donations, China’s furniture companies supported the work of the front.

According to the CNFA, over RMB 284 million worth of money and goods were sent to hospitals and charities. Stakeholders along the furniture value chain cared for each other. Such measures were taken as retail rent exemption, discount in factory price, financial aid, and others. A network of mutual trust and mutual help was formed in the broad furniture industry. For now, people are most concerned about how to strengthen daily protection and make up for the business loss. For example, consumers are increasingly interested in health. Human-friendly materials, designs, structures and the like become important elements furniture makers need to consider in their products so they can better meet market needs and increase sales.

As for exhibitions, some are going well, especially those large ones in March, including CIFF Guangzhou, 3F Dongguan, Dragon fair Longjiang. However, some are affected by the last year’s hit and have to cancel or reduce this year’s version. What should be pointed out that usually August and September are also important months when several big furniture exhibitions happen, but because of the recent spread of virus, all of them are postponed, including Furniture China Shanghai. Their postponement causes much trouble to furniture companies as new orders are delayed as well. To cope with this problem, exhibition organizers are launching online events to help exhibitors connect with buyers. This is a solution already adopted since last year.

In forecast China’s furniture industry will grow on a year-over-year basis in 2021. The recent surge in export and domestic consumption may die down by the end of this year or in 2022. However, the future trend is still of significant uncertainty as the overseas market is important for China but the international situation is exposed to both positive and negative risks.

From a mid-to-long term perspective, China furniture industry is faced with the particular challenge of its upgrading and transformation. The past advantages of solid manufacturing infrastructure and ability bring fewer marginal benefits. To keep the sustainable development, the furniture industry needs to adopt a new model combining intensive technology, cultural aesthetics, environment friendliness, high quality and flexibility in the whole value chain. China’s furniture brands are not competitive enough in the global stage. They need to go along a more innovative path to capture the high end of the global furniture industry.